Introduction to BBAI

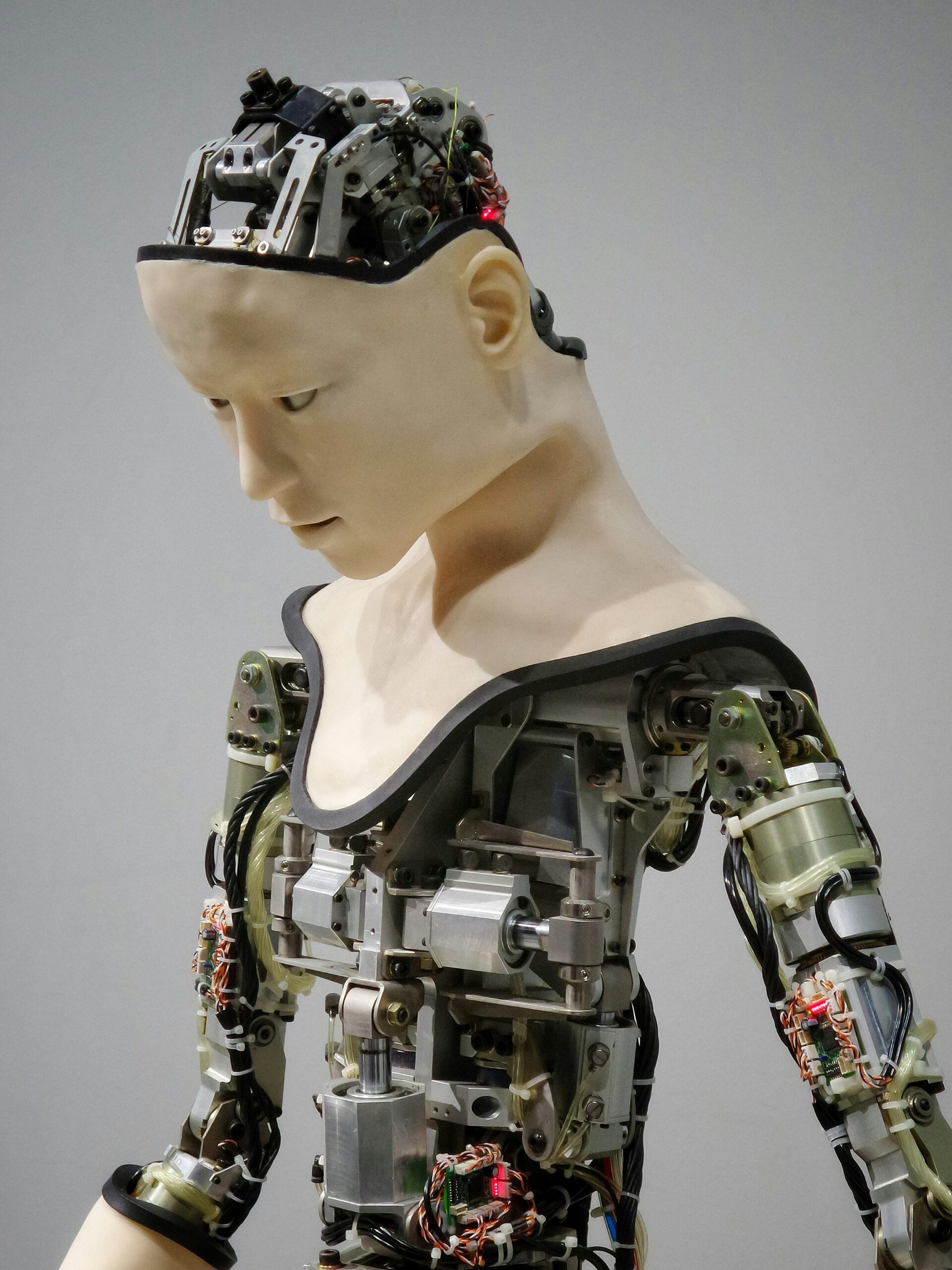

BBAI has emerged as a pivotal entity in the technology sector, positioning itself at the forefront of advanced innovations. The company specializes in developing cutting-edge solutions that leverage artificial intelligence, machine learning, and data analytics, all of which are highly sought after in today’s digital landscape. With a clear focus on harnessing advanced technologies, BBAI is not only addressing current market demands but is also anticipating future trends in the tech arena.

The relevance of BBAI’s products cannot be overstated, as they facilitate significant efficiencies across various industries including finance, healthcare, and logistics. These advanced technologies are essential for businesses aiming to enhance their operational capabilities and remain competitive in a rapidly evolving marketplace. As businesses increasingly integrate AI into their operations, BBAI is strategically positioned to benefit from this growth trajectory, further solidifying its role as a vital player in the tech industry.

Additionally, BBAI’s strategic initiatives, which include partnerships with leading tech firms and a commitment to research and development, have important implications for investors. The company’s focus on innovation ensures that it remains relevant and adaptable in the fast-paced tech landscape. Through these initiatives, BBAI has demonstrated an ability to pivot and evolve alongside the shifting dynamics of technology, which can greatly influence investment strategies. Investors may find BBAI’s approach to innovation and market engagement an attractive aspect, potentially leading to lucrative opportunities in the realm of technology investments.

Market Potential of Artificial Intelligence

The market for artificial intelligence (AI) has experienced substantial growth in recent years, positioning itself as a pivotal sector for technology investors. According to a report by Grand View Research, the global AI market was valued at approximately $62.35 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 40.2% from 2021 to 2028. Such impressive growth projections underscore the escalating demand for AI technology across various industries, including healthcare, finance, robotics, and automotive.

Businesses are increasingly recognizing the need for AI-driven solutions to enhance operational efficiency, improve decision-making, and provide superior customer experiences. For instance, AI applications in healthcare are revolutionizing diagnostics and treatment options, while financial institutions leverage AI for risk assessment and fraud detection. The adaptability and versatility of AI technologies present vast opportunities, allowing companies to innovate and capture market share in competitive environments.

In this context, BBAI stands out as a potentially significant player. The company is strategically positioned to capitalize on the expanding AI market by offering innovative solutions that meet the evolving needs of enterprises. By focusing on advancing AI capabilities, BBAI aims to enhance productivity and drive growth for its clients. Furthermore, several industry forecasts suggest that investments in AI will continue to rise, suggesting that companies like BBAI might see accelerated revenue growth in the coming years.

As institutions, governments, and corporations invest heavily in AI, the implications for tech investors are profound. The burgeoning market presents a myriad of investment possibilities, making it crucial for investors to stay informed about companies that are leading the charge in AI technology, such as BBAI. With its promising outlook and inherent growth potential, BBAI could emerge as a game-changer for investors seeking to benefit from this transformative technology.

Financial Performance and Projections

The financial performance of BBAI has drawn significant attention from investors as the company continues to show promising growth metrics in the technology sector. Recent earnings reports reflect a robust upward trajectory in revenue, growing an impressive rate compared to industry averages. BBAI recorded a year-over-year revenue increase of approximately 25%, largely driven by its innovative product offerings and successful expansion into new markets. This growth is indicative of the company’s capacity to capitalize on the evolving demands within the tech landscape.

Another critical aspect of BBAI’s financial health is its profit margins. The company has maintained a strong gross margin of around 55%, which is commendable within the tech industry. By controlling production costs while simultaneously enhancing operational efficiency, BBAI has been able to preserve and even improve its profitability despite the challenges posed by competitive pressures and fluctuating market conditions. Investors often favor companies that demonstrate solid margins, as this indicates effective management and a resilient business model.

Future earnings projections for BBAI look equally promising, with analysts expecting continued revenue growth driven by both existing operations and new ventures. Key for prospective investors is that forecasts suggest BBAI will expand its revenue by an additional 30% over the next fiscal year. Several factors contribute to this optimism, including anticipated advancements in artificial intelligence technologies and strategic collaborations that are expected to enhance market penetration. When compared to industry benchmarks, BBAI exhibits compelling financial resilience and growth potential, making it an attractive option for tech investors.

Technological Innovations Driving Growth

BBAI is at the forefront of technological advancements that are poised to markedly enhance its market position within the competitive tech landscape. Notably, the company focuses on artificial intelligence (AI) and machine learning (ML), incorporating these cutting-edge technologies into various products that streamline operations, enhance performance, and deliver personalized experiences for users. These innovations serve not only as distinguishing factors but also as pivotal elements in attracting potential investors.

One of the most significant developments from BBAI is its proprietary AI-driven analytics platform, which enables businesses to sift through vast amounts of data effortlessly. This platform’s ability to generate actionable insights empowers enterprises to make data-informed decisions, thereby enhancing their operational efficiencies. By leveraging sophisticated algorithms and real-time data processing, BBAI’s technology provides a substantial competitive advantage over traditional data analysis methods, marking a significant leap in technological innovation.

Additionally, BBAI has established strategic partnerships with several key industry players. These collaborations are instrumental in fostering innovation and enhancing product offerings. For instance, partnerships with leading cloud service providers have facilitated the integration of BBAI’s technology into existing IT infrastructures, ensuring seamless adoption for users. Such collaboration allows for scalability while maintaining control over system performance, showcasing BBAI’s commitment to delivering robust and adaptable technology solutions.

Moreover, BBAI’s unique selling propositions revolve around customization and user-centric design. The company emphasizes building solutions tailored to specific industry needs, which significantly enhances user satisfaction and retention. This approach not only differentiates BBAI from its competitors but also positions it as a trusted partner in technology transformation. As a result, BBAI is poised to capture a larger share of the tech market, making it an attractive option for investors looking for growth potential.

Competitive Landscape and BBAI’s Positioning

The competitive landscape within the tech sector is characterized by rapid evolution and intense rivalry among key players. Within this dynamic environment, BBAI has established a notable presence, differentiating itself through unique strategies and innovative product offerings. While established giants dominate substantial market shares, BBAI has carved out a niche by focusing on cutting-edge technologies that address emerging consumer needs.

BBAI’s approach involves leveraging advanced artificial intelligence capabilities, which confer significant competitive advantages. The company has positioned itself as a leader in AI-driven solutions, setting high benchmarks in efficiency and user experience. This focus enables BBAI to appeal to a diverse client base, from small businesses to large enterprises looking to enhance their operations. Furthermore, BBAI’s commitment to research and development ensures that it remains at the forefront of technological advancements, providing a robust barrier against competitors.

<pdespite a="" adapt="" additionally,="" advancement="" agile="" also="" and="" are="" bbai="" bbai's="" both="" but="" can="" challenges="" changes="" collaborations="" companies="" competitive="" competitors="" conditions="" consistently="" consumer="" continuous="" could="" economic="" ecosystem.<pin ability="" address="" advantages,="" against="" alongside="" and="" bbai="" bbai’s="" by="" can="" competitive="" context,="" customer-centric="" cutting-edge="" demands.="" effective="" evolve="" focusing="" for="" fortify="" growth="" harness="" hinges="" industry="" integrating="" its="" market="" on="" p="" pave="" positioning="" proactively,="" rivals="" sector.

Investing Risks and Considerations

Investing in BBAI stock, like any venture in the tech sector, is accompanied by inherent risks that prospective investors must carefully consider. One primary concern is market volatility, which is particularly pronounced in technology stocks. The tech industry often experiences rapid and significant price fluctuations driven by factors such as market sentiment, competition, and advancements in technology. Investors in BBAI must be prepared for potential short-term losses or gains as the stock reacts to external influences including economic conditions and investor perceptions.

Furthermore, regulatory challenges represent another critical consideration for BBAI investors. The technology sector is subject to a complex web of regulations that can impact operational practices and market entry. As technological advancements occur at an unprecedented pace, regulatory bodies are often playing catch-up, which may lead to uncertainty for companies like BBAI. Changes in regulations can affect profitability, impact business models, and may even impose restrictions on operational frameworks. Consequently, investors must remain vigilant regarding potential regulatory shifts that could influence the overall viability of the company.

Additionally, the threat of technological obsolescence cannot be underestimated. The rapid evolution of technology means that what is innovative today may quickly become outdated tomorrow. For BBAI to sustain its competitive edge, it must continuously innovate and adapt. If the company fails to deliver cutting-edge solutions or keep pace with advancements from its competitors, it may face declining market share. Investors should evaluate whether BBAI is positioned to stay relevant within its industry, as this will be critical in determining long-term investment potential.

Success Stories and Case Studies

BBAI Technologies has made noteworthy strides in the tech industry, showcasing the potential of its innovations through various successful applications. One illuminating example is the implementation of their artificial intelligence solutions in the healthcare sector. A prominent hospital network integrated BBAI’s predictive analytics platform, enabling them to anticipate patient admission rates more accurately. This application not only enhanced operational efficiency but also improved patient care outcomes by allowing for better resource allocation. The success of this initiative highlights the power of BBAI’s technology in improving critical healthcare processes, reflecting the company’s commitment to creating value in sectors that matter.

Another significant case study can be found in the manufacturing industry, where a major automotive maker adopted BBAI’s automation tools. By using BBAI’s machine learning algorithms, the company was able to optimize its supply chain management. This resulted in a 23% reduction in operational costs, demonstrating a direct correlation between BBAI’s technological input and financial performance. Such remarkable results emphasize how BBAI’s offerings can transform traditional industries, making them more efficient and financially viable.

Furthermore, BBAI’s innovations have been embraced by the retail sector. A leading e-commerce platform leveraged the company’s advanced recommendation systems to personalize customer experiences. As a result, the platform experienced a 40% increase in customer engagement and retention rates, showing direct benefits attributable to BBAI’s solutions. These diverse and successful applications across various sectors not only validate the effectiveness of BBAI’s technologies but also portray the potential for substantial returns on investment. Investors are likely to see such tangible outcomes as indicative of BBAI’s promising trajectory in the tech landscape.

Expert Opinions and Analyst Ratings

As BBAI stock garners increasing attention in the tech sector, industry experts and financial analysts have begun to provide insights and ratings that could shape investor sentiment. Analysts often evaluate a variety of factors, including the company’s financial performance, market trends, and competitive positioning, to forecast future stock performance. Current evaluations from leading analysts suggest a cautiously optimistic outlook for BBAI, emphasizing its innovative product offerings and potential for significant market penetration.

One notable assessment comes from a prominent investment bank, which recently reiterated a “Buy” rating for BBAI stock while adjusting its price target upwards. This revision is attributed to the company’s recent technological advancements and strategic partnerships that position it well to capitalize on the growing demand for artificial intelligence solutions. Furthermore, the bank highlighted that BBAI’s commitment to research and development not only bolsters its current product lineup but also paves the way for future innovations that could further enhance its market position.

In contrast, some analysts have expressed reservations regarding BBAI, pointing to potential challenges such as increased competition and regulatory scrutiny within the tech industry. These analysts suggest that while BBAI has impressive growth potential, investors should remain vigilant and consider these external factors when making investment decisions. Overall, the mixed sentiments among experts underline the importance of thorough research and the need for investors to balance risks and opportunities associated with BBAI stock.

As market dynamics continue to evolve, ongoing commentary and analysis will be vital for investors looking to navigate their strategies effectively. By staying informed about the latest expert opinions and ratings, investors can better position themselves to make sound decisions regarding BBAI stock and its place within their portfolios.

Conclusion: The Future of BBAI in Tech Investments

As we assess the landscape of technology investments, BBAI stock emerges as a compelling opportunity for investors seeking innovative growth solutions. The company’s focus on advanced artificial intelligence technologies positions it at the forefront of a rapidly evolving sector, making it a potential game-changer for those interested in the tech market. With increasing demand for AI-driven solutions across various industries, BBAI has demonstrated its capacity to innovate and adapt, consistently delivering products that align with consumer and enterprise needs.

The strategic partnerships and collaborations established by BBAI further bolster its market standing. By joining forces with key players in technology and research, BBAI is poised to enhance its product offerings and expand its reach within different sectors. This collaborative approach not only amplifies the company’s market presence but also signifies a commitment to leveraging shared expertise to drive technological advancements.

Investors should also take into account the robust financial metrics BBAI has reportedly achieved. Steady revenue growth, coupled with proactive management strategies, reflects a business model capable of weathering market fluctuations. In the current investment environment, characterized by rapid technological change, BBAI’s strong fundamentals and growth potential position it as a worthwhile consideration for investors looking to capitalize on the tech sector’s future.

Considering all these facets, BBAI stock represents more than just an attractive investment opportunity; it embodies the very essence of innovation that is reshaping industries. Moving forward, stakeholders should remain attentive to market trends and BBAI’s strategic decisions, as these factors will undoubtedly influence the company’s trajectory in the tech investment arena.